The H-1B program allows non-U.S. citizens a legal way to work in the United States if conditions are met by the employee and employer.

The two most critical conditions are:

- The employee must be a professional level worker with a bachelor’s degree (or equivalent); and

- There must be insufficient U.S. workers for the type of work the employee will be performing (qualifying positions are generally in the fields of IT, hotel management, physical therapists, and other white collar positions).

Federal regulations govern the H-1B program (20 C.F.R. § 655, for example) to ensure that the employees are getting sufficient protection from their employers.

To get approval for a particular employee, the employer must file a Labor Condition Application (“LCA”), which specifies the wages that will be paid to the employee (annually or hourly), whether the employee will be full-time or part-time, the duration of the employment, and other details related to the employment and employer.

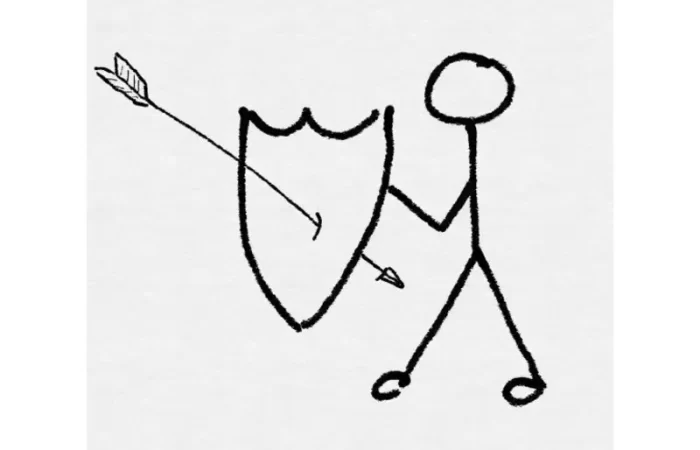

In some instances, employers are not complying with the regulations, which often results in the employee not being fully compensated and/or the employee being charged expenses for which the employer is obligated. The lack of financial compensation can take many forms, but here are a few examples:

- No Work or “Benching”: employer does not have work or an assignment for employee, so employer decides to “bench” the employee or make the employee find an assignment or project and not the pay the employee during this period.

- Different type of work: employer does not have the right type of work for employee, so employer decides to pay employee a lesser wage or not at all.

- Underpayment: each job has a minimum wage requirement based on the profession and location, which is known as the “prevailing wage” and is used to calculate the wage on the LCA, so anything less than the wage on the LCA is underpayment.

- Unequal Benefits: H-1B employees are entitled to benefits comparable to non-H-1B employees, which may include, medical insurance, dental insurance, paid time off, etc.

- Expenses: employers are not permitted to make unfair deductions from employee’s wages for costs associated with the H-1B or visa application, rent, travel, etc.

- Required Leave Form: employees are permitted to take voluntary leave, but the employer is not permitted to force the employee to sign a “voluntary” leave form to avoid paying wages to the employee.

- Job Performance: employers are not permitted to withhold wages based on claims that employee’s performance was unsatisfactory.

- Preventing Transfers to New Employers: Employers are not permitted to forbid employees from transferring to another employer or require the employee to pay a penalty for transferring.

If you are working in the U.S. as an H-1B employee and your employer has engaged in one or more of the above-mentioned practices, please contact Steven Krieger Law for a confidential consultation. The consultation will include a discussion of the specific facts surrounding your employment and how you may recover the wages you are owed.